How To Register Llc In Oklahoma

Starting a new LLC (limited liability company) or navigating the rules for doing concern in some other state for your existing LLC tin can be challenging for new business owners. If you plan to start an LLC in Oklahoma, we have you lot covered with this step-past-stride guide.

The initial filing fees and requirements for incorporation are minimal. Plus, if you plan to operate a concrete business organization out of this state, you'd love the low living costs, taxes, and employee hiring overheads.

Having said that, let'southward see how to first an LLC in Oklahoma.

6 Steps to Open an LLC in Oklahoma

- Step 1: Pick a concern name for your new LLC

- Stride 2: Designate a registered agent

- Step three: File Oklahoma LLC articles of organization

- Step four: Obtain an EIN (Employer Identification Number) from the IRS

- Pace 5: Prepare an LLC operating understanding

- Step 6: Open up a business concern banking company account

Footstep 1: Option a business name for your new LLC

A legal concern name is required for every new Oklahoma registered concern entity.

The name has to be substantially dissimilar from those registered by other companies. And run into several other requirements:

- Include the words Limited Liability Company or Limited Company, or an abbreviation indicating this blazon of concern entity, such as LLC, LC, L.L.C, L.C., or Ltd.

- Be distinguishable from the visitor names of corporations that existed in Oklahoma within the past three years.

- Don't include restricted words, such as ones pertaining to certain professions and those that may be confused with regime agencies.

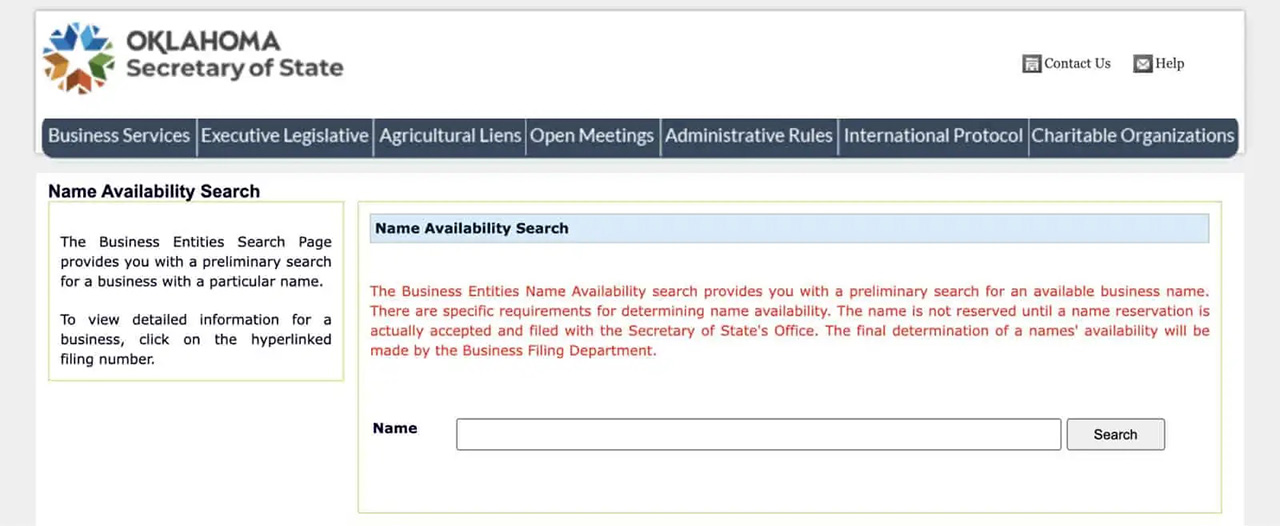

Once you've come up up with a name, you can find out whether your called business proper noun is bachelor by using Oklahoma's Secretary of State's business entity proper noun availability search tool.

Alternatively, y'all tin can phone call the Secretarial assistant of State office to ask about name availability by telephone at 405-522-2520.

This option also gets the office to confirm that your choice is sufficiently different from other registered business entity names.

Proper name reservations

If you're yet preparing your company germination documents and sorting out some other operational deets, information technology's worth having your selected LLC proper noun reserved.

To go a name reservation in Oklahoma, submit a filing form and a $10 fee. Filings are accepted online and by mail service.

Business organisation name reservations are valid for lx days.

Merchandise proper noun

If you plan to operate your business under a name different from your legal one (or have multiple brands under your LLC umbrella), it makes sense to file for a trade proper noun with the land.

Also known as doing business concern as (DBA), a merchandise proper noun showcases a connection betwixt your business entity and the selected assumed name. The cost is $25 per proper noun, and you lot must fill up in a separate form.

Filing for a Trade Name with Oklahoma serves a dual purpose:

- Keeps another business entity from using your LLC's name similar to a country trademark registration.

- Ensures proficient standing and compliance with the Secretarial assistant of State and prevents trademark issues with other Oklahoma registered businesses.

Note: For extra protection of your brand name and other intellectual property, you can also file for federal trademark registration with the United States Trademark and Patent Office (USPTO). This registration, however, takes more than time and is more expensive ($250-$350 per class).

Footstep 2: Designate a registered agent

All Oklahoma LLCs must have a registered agent to have service of procedure of legal documents, such every bit in instances when the limited liability company is part of a lawsuit.

A registered agent must:

- Be an individual resident of OK, 18 years of age or older, or a qualifying business organization

- Have a street accost in Oklahoma. P.O. boxes are non accepted

- Be available at the said concrete address during regular business hours

You lot tin can exist your own registered amanuensis if y'all come across these requirements.

Even so, some LLC members choose to hire a registered agent service instead. Information technology makes sense for out-of-state companies without a physical presence in OK.

It may besides be preferable for single-member LLCs operating from dwelling house addresses and keeping that address private from public records.

The costs range from $39-$250 (approximately), depending on the service you cull and whether you desire to add additional formation services or ongoing operating assistance as part of the service package.

Annotation: Foreign LLCs can choose to designate an boosted registered agent and registered function in the land of Oklahoma. If no registered agent for the foreign LLC is appointed, then the OK Secretarial assistant of State will serve as the foreign LLC'southward registered agent to receive service of process in this country. At that place'due south an additional annual fee of $xl if the Secretary of Land acts every bit a foreign LLC's registered agent in OK.

Step 3: File Oklahoma LLC articles of arrangement

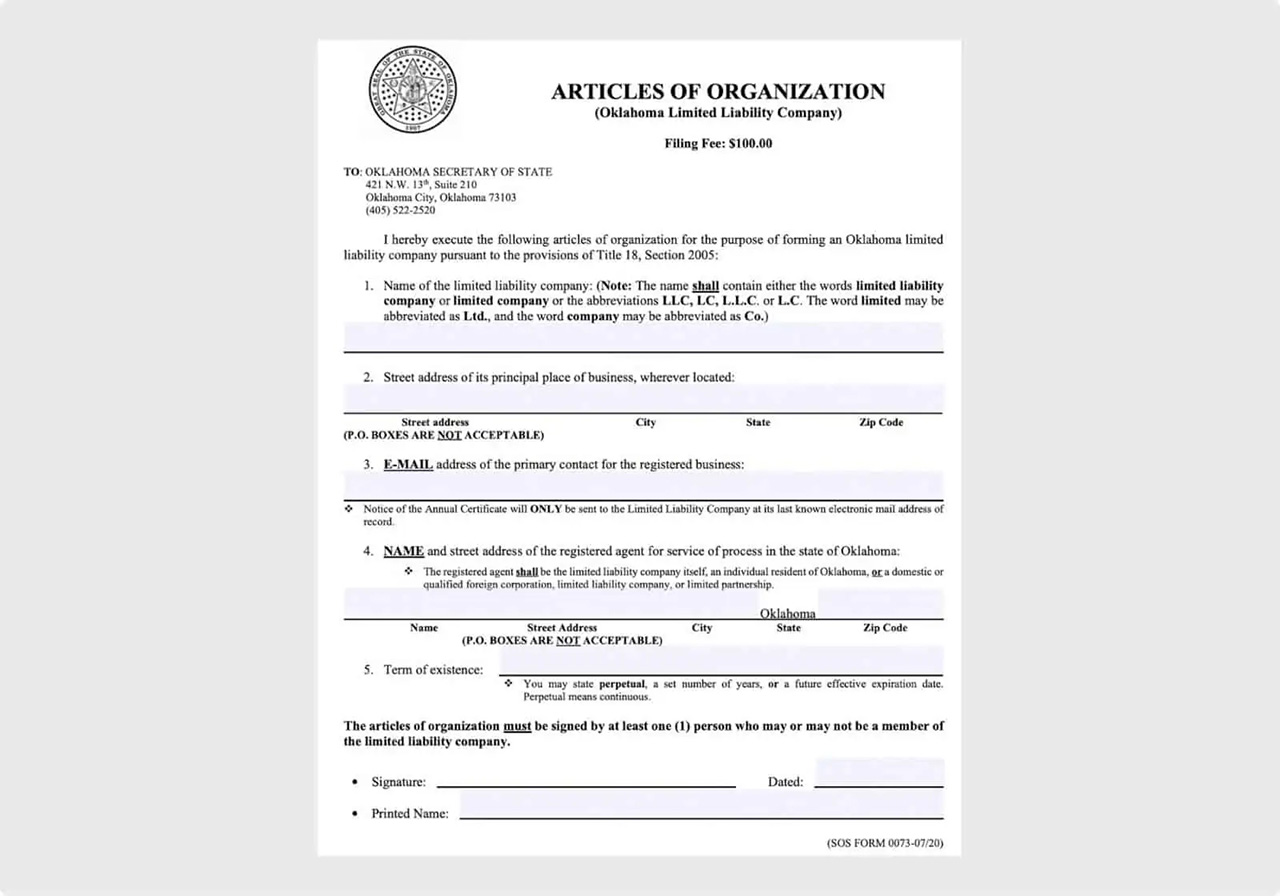

To form an LLC in Oklahoma, you must file articles of organization for your LLC, either online or by postal service, to the Oklahoma Secretarial assistant of Country's Oklahoma City office and pay a $100 state fee.

This filing is the primary requirement for company formation.

Oklahoma LLC articles of organization must contain certain information:

- Your LLC's business name

- Street address of your LLC'southward principal place of business (notation that this cannot be a P.O. box accost)

- An email address for your LLC's main person of contact (which is where annual registration documents will be sent)

- Name and street address for the LLC's registered agent

- Term of existence for your registered business concern

- Signature of at least one person — the LLC organizer

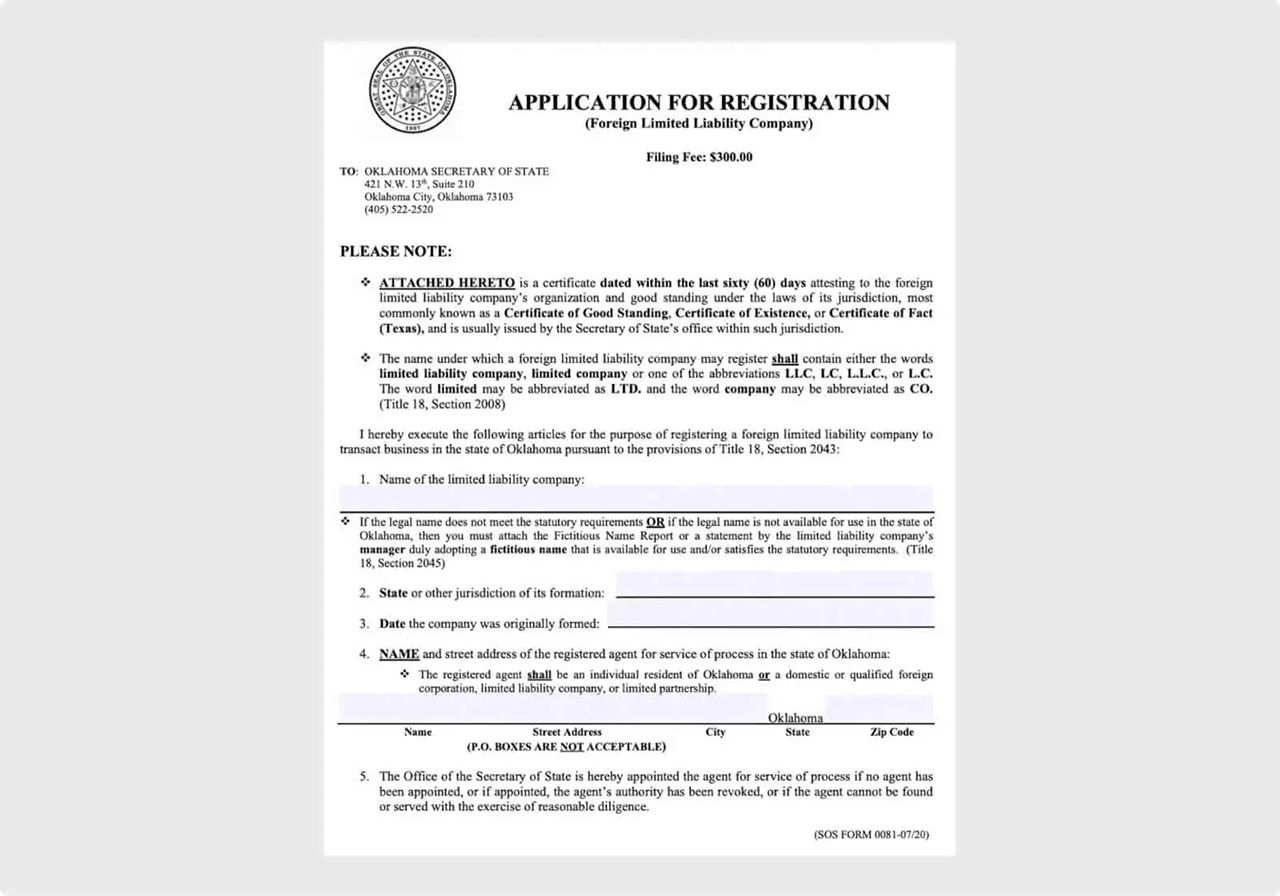

Registering a strange LLC in Oklahoma

If your Express Liability Company (LLC) is organized in another U.Southward. state but expects to practise business in Oklahoma, it should register with the Secretary of State as a strange LLC.

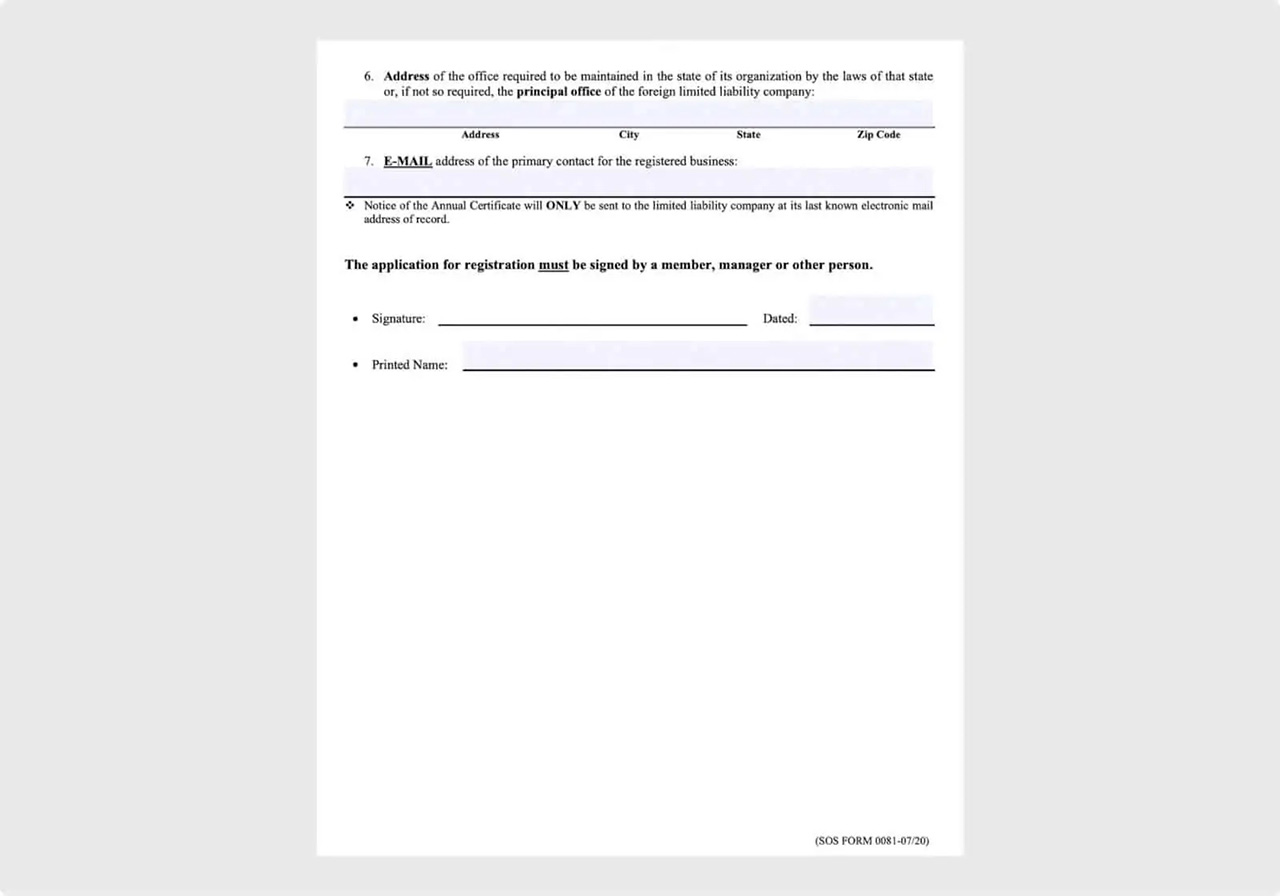

There's a separate registration class for strange LLCs. The filing fee is $300. The form requirements are similar to domestic LLC formation.

Notwithstanding, it also must include a Certificate of Good Continuing from the Secretary of State's role for the land that the LLC is organized. The document can't be older than 60 days.

Step 4: Obtain an EIN (Employer Identification Number) from the IRS

Your Oklahoma LLC may crave an employer identification number (EIN).

EIN is a unique number associated with your business concern construction. The Internal Revenue Service (IRS) uses it to identify your LLC on federal tax returns and other revenue enhancement filings.

To obtain your LLC's EIN, you can apply online. The toll is free, and your LLC will get its EIN immediately upon filing with the IRS one time all information is verified.

Single-fellow member LLCs, filing federal taxes every bit a sole proprietorship, can skip this step. Only in some cases, having an EIN is mandatory:

- Any LLC or small business organisation entity with employees must accept a federal EIN.

- LLCs filing taxes as a corporation (C-corporation or S-corporation) or partner need an EIN.

- Also, companies in federally regulated industries need this number.

Stride v: Fix an LLC operating agreement

For multi-member LLCs or manager-managed LLCs, a written operating agreement is recommended.

An operating agreement establishes the rights, obligations, liabilities, turn a profit and loss share, officer roles, member roles, and other provisions laying out the LLC's members' rights and obligations to each other and the LLC as a business entity.

This document is not required to be filed with the Oklahoma Secretary of State. However, it should be kept on internal records.

Without an operating agreement, whatsoever possible disputes volition exist governed only by the articles of organization and Oklahoma laws.

It can complicate things, whereas having it all laid out in an operating agreement makes sure all members are on the same page. Not having an operating understanding may also increase the scope of your personal liability as your business owner.

To brand an operating agreement, y'all can become a template online or seek assist from an attorney or formation service.

Step vi: Open up a business bank account

Opening a business concern bank business relationship for your LLC is highly advised.

Why?

You can more easily keep runway of your business income and expenses and separate them from personal ones. It helps with taxes, allocating profits, payroll, and determining business profitability.

Besides, information technology lets yous become business organization checks and credit cards. Only most importantly, a separate business organisation banking company account prevents from commingling business and personal avails, which can lead to legal bug.

Some banks require that your LLC have an EIN to open a business bank account. Others don't.

On boilerplate, monthly fees are $12-25, but some banks waive the fees if you keep a minimum residuum.

Your business banking company account doesn't have to be a local depository financial institution. You can cull a national banking company just will likely need to set an account with a local branch.

Taxes, costs, and fees in Oklahoma

Mail service-formation, the spending doesn't stop. Oklahoma LLCs are subject to sure annual costs, taxes, and other fees.

Annual report toll

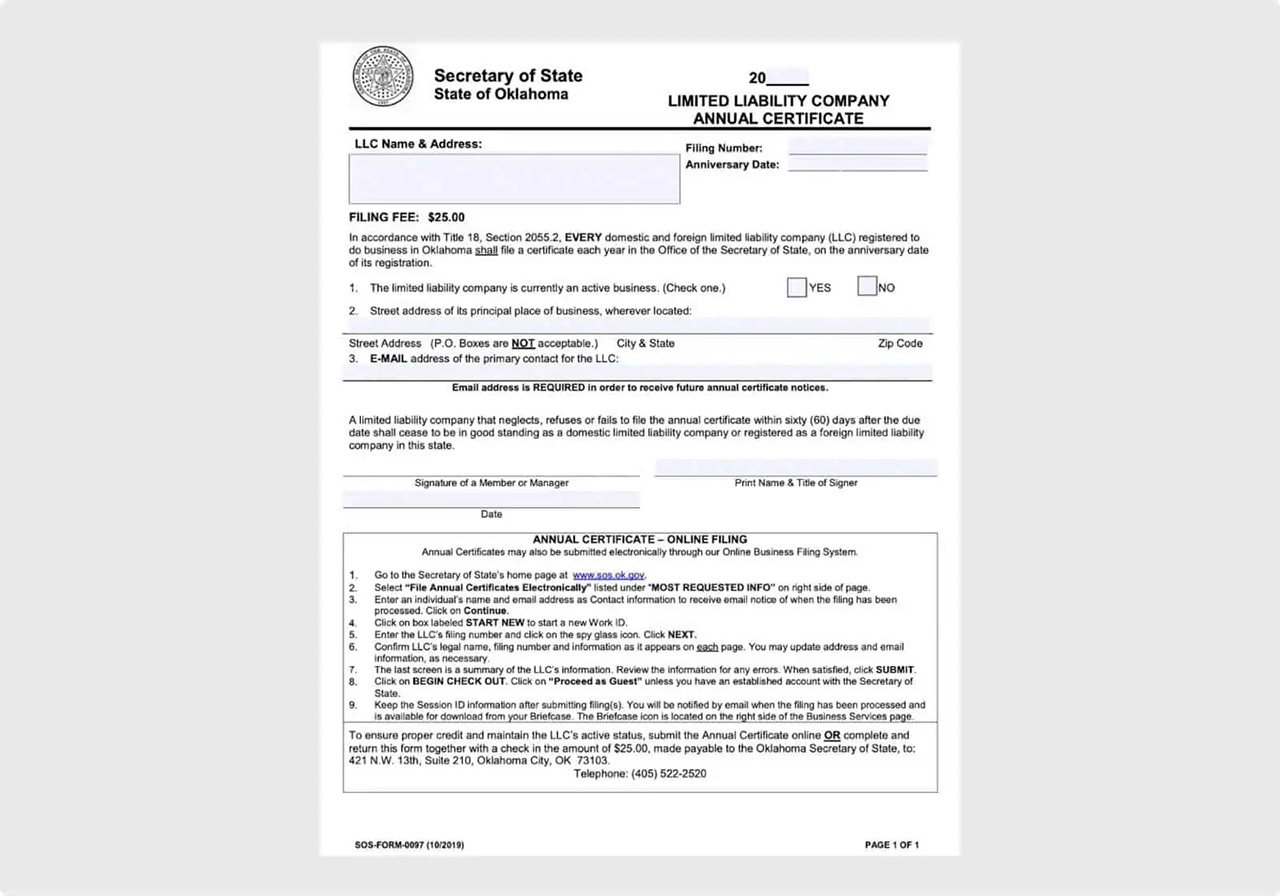

First, in that location's an annual certificate requirement for both domestic LLCs and foreign LLCs doing business in the state of OK. It's due on the anniversary date each year for when your LLC is registered.

The filing fee for the annual document is $25. Note that data for the annual certificate will exist sent to the e-mail accost listed on your LLC's articles of organisation.

State LLC taxes

Your LLC may owe state taxes if some conditions apply. These include:

- Sales and use tax for selling tangible goods in the state

- Alcohol/mixed beverage tax for businesses selling alcohol

- Motor fuel taxation for wholesalers selling such in the state

Additionally, LLCs with employees may owe additional state taxes for unemployment insurance, income tax, and payroll benefits.

Register your LLC with the Oklahoma Tax Commission to file state taxes.

If you're unsure of your LLC's tax obligations, yous tin call the Oklahoma Taxation Commission and local authorities agencies for a consultation. Or you lot may want to talk to a tax expert.

Business permits and licenses in Oklahoma

Oklahoma doesn't require any general business licenses.

However, some businesses and professional service providers may need to obtain occupation-specific licenses or permits. These may be required at the state and local levels.

Common types of businesses with license requirements include construction companies, pools, restaurants, confined, whole-sellers, retailers, transportation companies, and businesses providing consumer credit services.

Another common requirement is obtaining a sales tax permit from the Oklahoma Tax Committee (OTC). Retail businesses need to register their LLC with the OTC, collect sales taxes on goods sold, and remit taxes due to the OTC the post-obit month.

Pros and cons of creating an LLC in Oklahoma

Forming an LLC in Oklahoma provides some cracking benefits, such equally low filing costs and affordable maintenance fees.

Overall, the physical price of doing business in the land is attractive too. Nonetheless, there are several downsides worth taking into account.

The good:

- Depression business concern registration costs

- Cash incentives, revenue enhancement credits, and other pro-business packages

- Low tax burden — ranked #two in U.S. states for the lowest concern revenue enhancement burden

- Energy costs are 22% lower than the national average as of 2021

- Primal location and good hiring prospects (with incentives and regulations that make the price of hiring lower than in many other states)

The bad:

- Not the all-time business organization climate and lack of potent business community

- Annual certificate filings and state fees apply

- Fundraising may be difficult, as investors tend to be more than comfortable with business organisation organized in some of the more popular states for incorporation

- Less guidance is bachelor every bit compared to more than popular states businesses cull for company germination

Oft asked questions

Below are some of the most frequently asked questions (FAQs) most forming an LLC in Oklahoma.

How To Register Llc In Oklahoma,

Source: https://www.simplifyllc.com/llc-formation/start-oklahoma-llc-3244/

Posted by: macdonaldgriat2000.blogspot.com

0 Response to "How To Register Llc In Oklahoma"

Post a Comment